Niteen Dharmawat, co-founder of Aurum Capital presents a SME stock presentation in Aphaideas T20 stock event.

Disclaimer : This is not a stock pick from Aurum Capital

Niteen Dharmawat, co-founder of Aurum Capital presents a SME stock presentation in Aphaideas T20 stock event.

Disclaimer : This is not a stock pick from Aurum Capital

Here’s the link to Aurum Capital’s co-founder Jiten Parmar’s interview on CNBC

Operating cash flow (OCF) is the key to understanding how well a company is doing. It defines whether, and how much of, the revenues are getting converted to cash. However, most investors lean towards net profit (NP) as the primary metric of a company’s performance. Why?

One of the main reasons is that OCF numbers are provided once in a year while the net profit numbers are provided at the end of every quarter. This gives an opportunity to the media and so-called experts to discuss NP at least four times a year and, accordingly, be more worried—or excited—about growth.

Also, many small investors find it difficult to read these numbers in the annual reports primarily because of fear of the unknown. How does one arrive at OCF and how is it different from NP? Let’s first define NP and OCF, before we proceed to explore the importance of each of the terms.

NP comes from the profit and loss (P&L) statement, while OCF comes from cash flow statement.

Net Profit: Net of revenue or sales after minusing all operating expenses, depreciation, interest and taxes, including any other income and taking into account exceptional items.

Operating Cash Flows (OCF): The net cash generated from operations.

Investing Cash Flows (CFI): The net result of capital expenditure, investments, acquisitions, etc.

Financing Cash Flows (CFF): The net result of raising cash to fund the other flows or repaying debt.

Why OCF and not NP: OCF is a better metric of a company’s financial health for two main reasons. First, cash flow is harder to manipulate than net income. Second, ‘cash is king’ and a company that does not generate cash over the long term is heading towards getting wiped out. OCF gives you the picture of the cash received in the organisation. Without cash, the company may not be able to fulfill its promise to make payments to suppliers, employees and financial institutions on a sustainable basis.

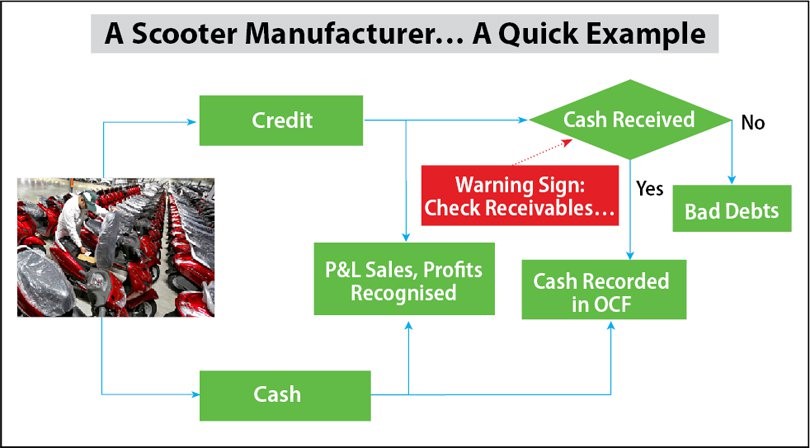

Accrual Accounting System vs Cash Flows: To generate NP, a company may be required to just make a sale. This sale could be either in cash or on credit. If it is a cash sale, it gets recognised in OCF also.

However, business reality is a bit more complex. Most companies provide credit facilities. This could provide an opportunity to manipulate the net profit numbers. Imagine a company that makes a credit sale and, based on it, immediately recognises the sales in the P&L and, accordingly, arrives at the NP number. However, the cash is not received and, hence, OCF does not go up.

What happens if the customer delays the payment or returns the goods or if the sale was bogus? This results in a build-up of receivables in the balance-sheet. But the real OCF has never happened. The company may continue to do so but not indefinitely. It will have to face the reality at some point in time. The receivables numbers then will turn bad debts and result in pain.

Seven Examples

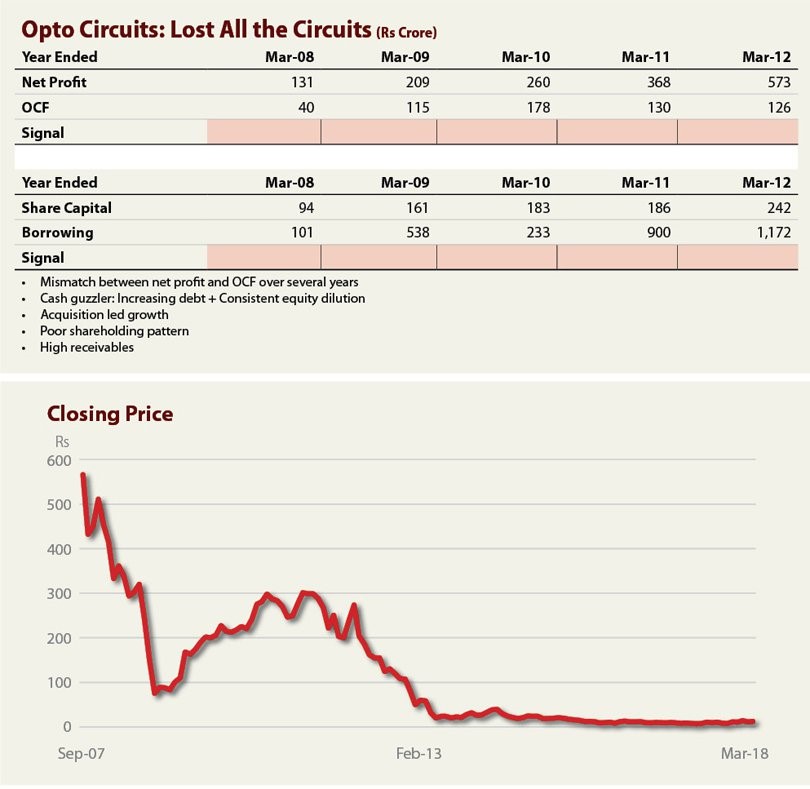

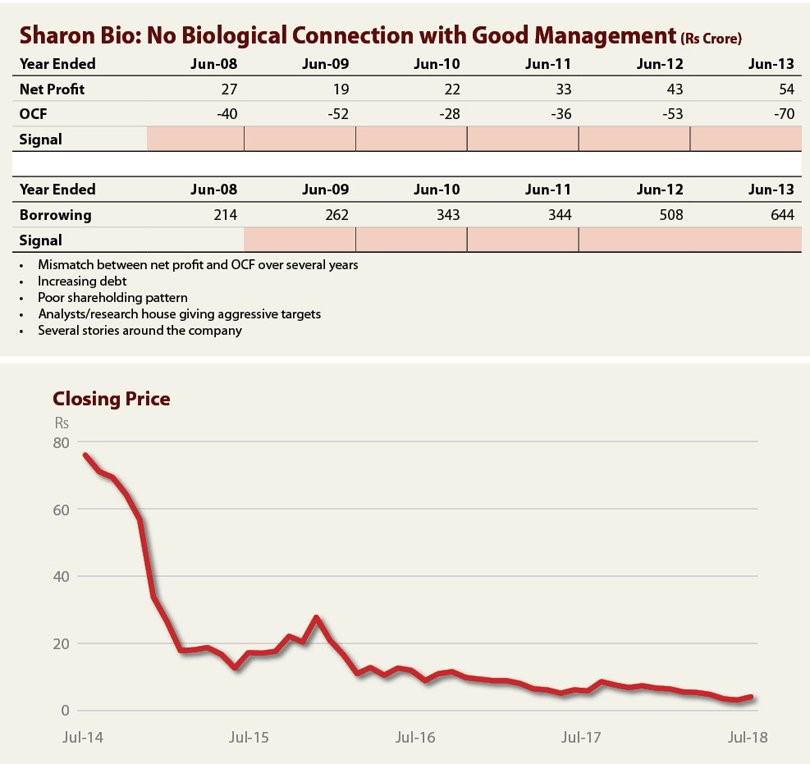

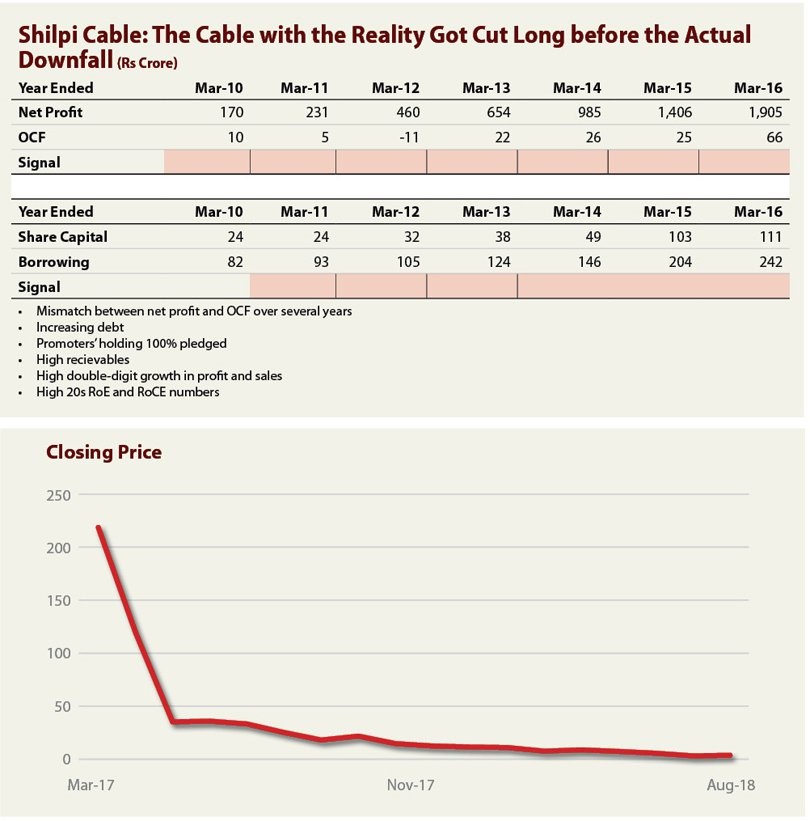

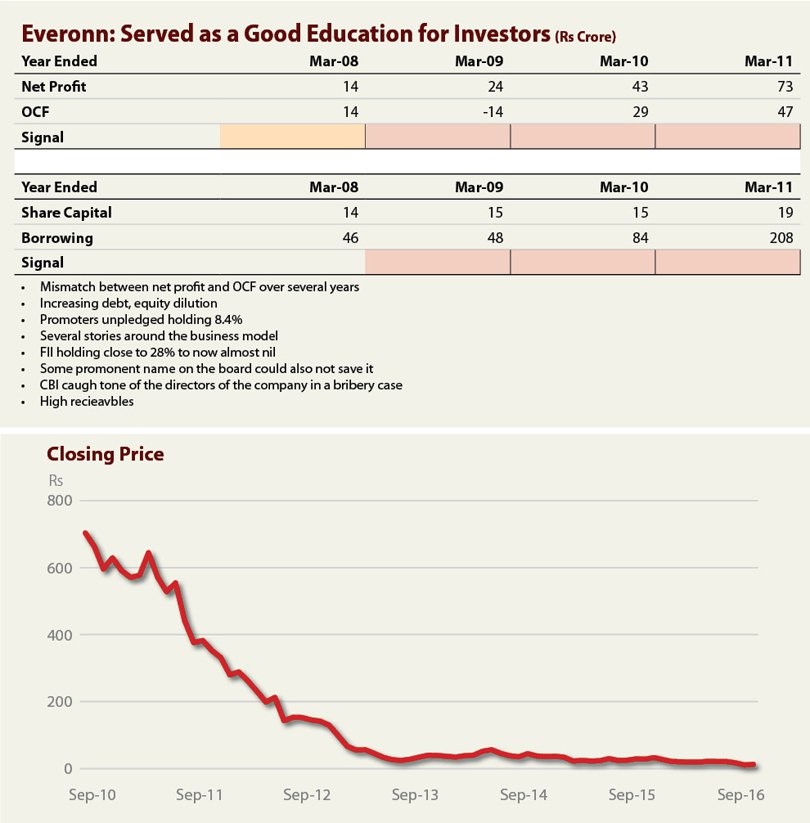

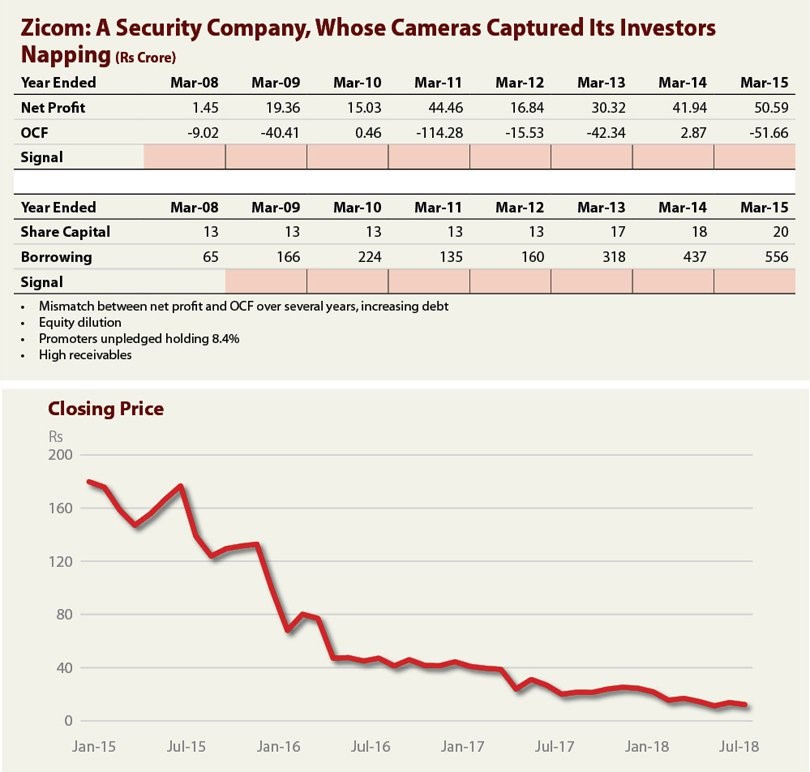

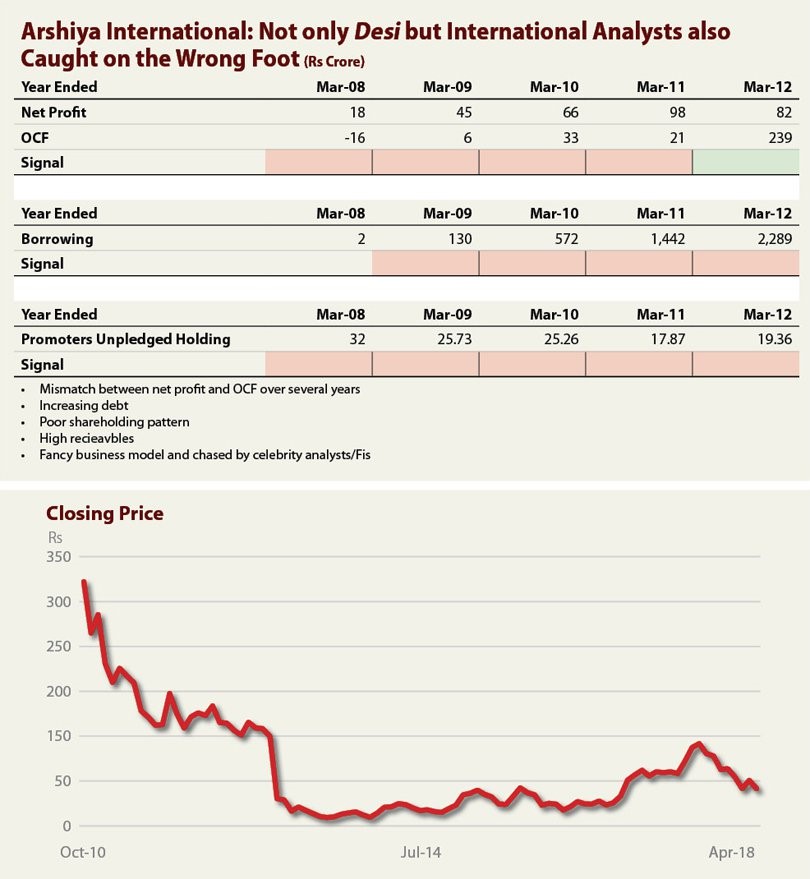

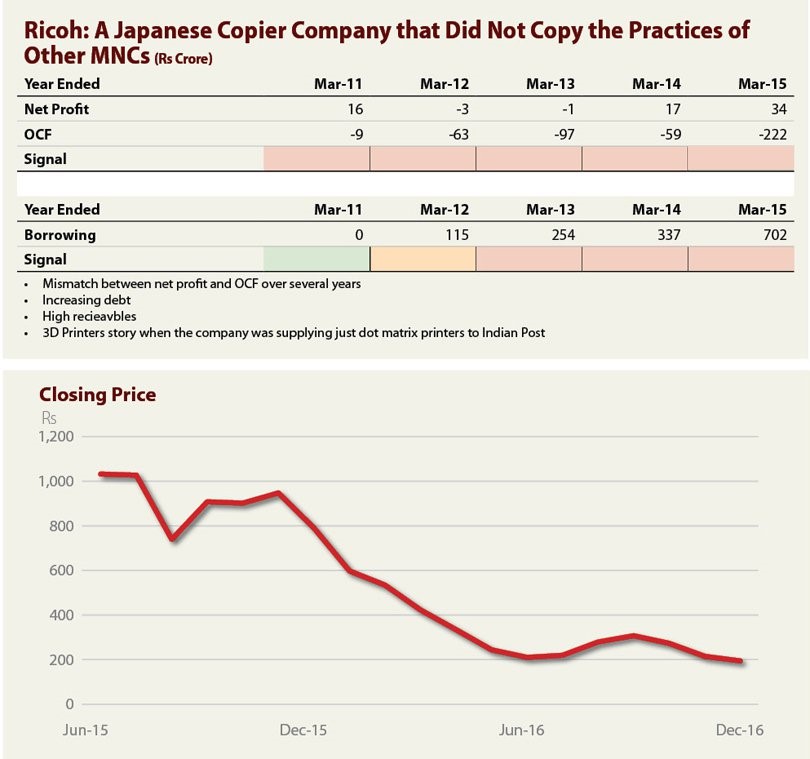

There have been several examples where companies were not generating cash flows but continued to show profits through various means. These companies faced the grim reality at some point in time and their stocks collapsed. Also, if the promoters’ holding is poor or there is a continued equity dilution along with poor OCF, it becomes a deadly cocktail.

There are hundreds of examples. I have chosen seven examples to highlight how following NP and OCF can mislead us. Why these examples? Well, these are some high-flying cases in which many media-savvy analysts, institutional investors, and retail investors have invested or have talked about them. I have discussed these companies with many friends and relatives in the past due to our mutual interest in stocks. I have taken the data only up to the point where I have analysed it last when faced with such queries.

I found a common element in companies with poor OCF. These companies are, often, backed by very strong growth stories and are widely traded in the stock market with lots of hope. These companies were the cynosure of the eyes of stock market players. In these seven cases, too, the stocks were running high with growth stories being spread by analysts and large investors. Eventually, these companies’ stocks, and those of several such companies, which were unable to generate OCF, just crashed by as much as 95% from their peak price.

Ideal Situation: How do we know what the NP should be? In an ideal situation, the ideal OCF vsNP ratio should be close to one. The higher the OCF, the better it is. However, there could be a year or two where OCF is down due to market conditions or specific circumstances. But it cannot be for an indefinite period; otherwise, the survival of the company will be in question.

OCF Can Be Fixed Too: One more word of caution. Companies can manipulate OCF also. That’s where a glance at the balance-sheet can catch any discrepancy. Positive OCF can be generated by decreasing the non-cash working capital. Decreasing non-cash working capital means liquidating items like inventory, receivables (you are supposed to get this money from your customers and not by selling it off in the market at a discount) or increasing payables (you are supposed to pay your suppliers and which you don’t).

Are these steps, like liquidating receivables, inventories or increasing payables sustainable? Not at all! Inventories and receivables cannot fall below zero and creditors will not extend credit indefinitely, unless payments are made when due.

One must go through the balance-sheet numbers to see if there are any marked changes in receivables, payables, or working capital numbers from the previous year’s numbers. If so, you know where the problem is.

Exception: There are some exceptions to the rule of OCF, especially with respect to companies that deal only with cash—that is, banks and finance companies. The OCF rule is not applicable in such cases or it needs to be tweaked extensively.

Other Helpful Parameters along with OCF

In addition to OCF, if we also consider the following parameters, it would further help us in our analysis.

Final word: NP without OCF is like a body without oxygen and if it is coming with low promoter shareholding, equity dilution and high debt, it is a sure death warrant for the investor.

Reference: http://www.investopedia.com for definitions

Author and disclosure:

Niteen is one of the founders of Aurum Capital, a SEBI-registered investment adviser. Stocks mentioned in the article does not constitute personal recommendations. The analyst does not hold any of the stocks mentioned in the article above.

Note:

This article was originally published in Moneylife magazine.

Dear All,

Jiten Parmar, the co-founder Aurum Capital, is interviewed by The Unlimited Abundance.

This podcast reveals his 3 principles of investing discipline which helped him amass Multibagger returns with amazing ease.

https://www.youtube.com/watch?time_continue=2&v=-lCU7UVqqPA

Please do share your inputs.

Regards,

Aurum Capital

SEBI registration No: INA000011024

Important Disclaimer:

The stocks named, if any, during the interview are for educational purpose and are not recommendations of any kind (Buy/Sell/Hold). Please consult your registered Investment Advisory or Analyst before taking any financial decisions.

Enter your email address for unsubscription.

Subscription to our blog and newsletter