Here is the video link of the presentation Jiten Parmar made at PPFAS FOF in Dec 2019. Viewing time : 88 min

All about cycles and cyclicals – Jiten Parmar at CFA Society – Dec 2019

How To Safeguard Yourself from Karvy-type Frauds?

This article written by Niteen S Dharmawat, co-founder of Aurum Capital, has appeared in Moneylife magazine. You may find this of use.

Recently, the Securities and Exchange Board of India (SEBI) found that Karvy Broking had illegally diverted nearly Rs2,000 crore of clients’ shares to its own accounts. Equity brokers have defaulted in the past as well, but this is surely one of the largest cases. Also, remember that there is never a single cockroach in the kitchen; we might have more such cases. So what should you, as an investor, do to protect your interest?

Power of Attorney (PoA): Brokers insist on PoA which allows them to operate your demat account. This is a necessary evil. Without PoA, the trade settlement becomes highly risky for the broker. What if you do not deliver the shares you have sold? However, with PoA, brokers have a route to misuse your stocks. The PoA should be limited only to market trades and, as per the latest SEBI rules, brokers need to call you before they execute any trades on your behalf. These calls are recorded. If you receive calls from a mobile phone, do not entertain them. Also, keep a recording on your files.

Delivery Instruction Slips (DIS): DIS is an alternative to PoA for trade settlement. But it is cumbersome for many in the era of the Internet. There is an alternative to DIS that is also elaborated below.

Download the Mobile Apps of CDSL/NSDL: Depending on where your demat account is, download and configure the app for your demat account. You would need your demat account number, PAN (permanent account number) and your date of birth, to register. The demat account has a 16-digit numeric character (in case of CDSL), whereas in case of NSDL, the demat account number starts with ‘IN’ followed by a 14-digit numeric code. An example of a demat account number with CDSL can be 01234567890987654; a demat account number with NSDL can be IN01234567890987.

Verify DP Holding with Broker Holding: Once your DP app is set up, you can see your holdings in the DP account. Never forget to verify your DP holding at least once a month and crosscheck it with what you see in the broker’s holding. It will not take more than five minutes (unless you have hundreds of stocks).

Verify Pledging of Your Stocks: Whenever you get the details of your stocks with the DP, also check if any stocks have been pledged without your knowledge. This can be another route to misuse your holding.

Transfer the Cash: Preferably transfer the cash lying with the broker to your bank account. It does not earn anything; the cash remains idle with the broker and is open to misuse.

Active vs Dormant Account: People do invest for the long term and, as they say, buy and forget. Please do not do that in India, at least. Keep your account active. If you have a sizeable holding in your account and if your account is not active, it could become the target of a rouge broker. It can happen not only with stocks but also with the bank account. Yours truly is a victim of such a fraud in one of the leading banks where my wife’s dormant bank account was compromised. So be careful and keep it active, maybe by way of logging into the account to verify the details/once a month trade, etc.

Check Client Master: The client master has critical information related to your address and mobile number. Keep it up-to-date and verify it from time to time.

Full-service Brokers vs Discount Brokers: I got messages from the worried investors about their holdings with discount brokers. I also read articles that discount brokers will suffer the most after the Karvy scandal and investors will move to the full-service brokers. It is important to note that Karvy was not a discount broker. It was a full-service broker. Frauds can happen anywhere.

People have recommended many full-service brokers on various social media platforms instead of discount brokers. There is nothing wrong with full-service brokers or, for that matter, with discount brokers. The choice is with the individual.

I would suggest that you go with a broker who is large in size, has execution capabilities and provides uninterrupted services with a stable platform (especially during periods of high volatility). One can also select a combination of full-service and discount brokers.

Some Other Preventive Measures

- Use CDSL’s ‘easiest’ or NSDL’s ‘speede’. These are Internet-based facilities that permit clearing members of beneficial owner (clients) to submit off-market, on-market, inter-depository and early pay-in debit instructions from their demat account.

- When you register for easiest/speede, the broker loses the PoA over your demat account; this would mean that you cannot sell shares from your holdings using your trading platform because the broker will no longer be able to debit your shares from the demat account. You will now have the power over your demat account as a result of which you will be able to transfer shares using easiest/speede.

- Separate your broker from the DP. For example, your DP for the holding can be a prominent broker while your broker for the trading purpose could be a small/discount broker who charges less.

Do these steps and best practices guarantee that fraud will not happen? No, it does not; because fraudsters are always there to find new gaps in the system. But these practices will surely help in the early detection of fraud/misuse of funds/securities. If there are any new ways/gaps, they should be followed with newer practices.

Trust this helps. As always, we look forward to your feedback.

Happy Investing.

Sectors to watch out for 2019 and beyond – Jiten Parmar in Economic Times – Jan 1, 2019

An article in Economic Times by Jiten Parmar of Aurum Capital where he shares the sectors he thinks can outperform in 2019 and beyond.

Jiten Parmar’s presentation at IC 2018, Live on bloomberquint.com – Oct 2018

This is the presentation that Jiten Parmar made at IC 2018, and which was presented on bloombergquint.com . The live feed and the presentation both are attached below. We believe it will be good for investors to see the presentation and understand the psychological aspects of investing and learn some traits of successful investors.

https://www.slideshare.net/JitenParmar4/investor-behavior-traits

Niteen S Dharmawat on Bloomberg Quint covering Jash Engineering

Niteen Dharmawat, co-founder of Aurum Capital presents a SME stock presentation in Aphaideas T20 stock event.

Disclaimer : This is not a stock pick from Aurum Capital

Jiten Parmar’s interview on Cyclical Investing on CNBC – 13 May 2018

Here’s the link to Aurum Capital’s co-founder Jiten Parmar’s interview on CNBC

Picking Stocks: These 7 Examples Show Why Operating Cash Flow Is More Important than Net Profit

Operating cash flow (OCF) is the key to understanding how well a company is doing. It defines whether, and how much of, the revenues are getting converted to cash. However, most investors lean towards net profit (NP) as the primary metric of a company’s performance. Why?

One of the main reasons is that OCF numbers are provided once in a year while the net profit numbers are provided at the end of every quarter. This gives an opportunity to the media and so-called experts to discuss NP at least four times a year and, accordingly, be more worried—or excited—about growth.

Also, many small investors find it difficult to read these numbers in the annual reports primarily because of fear of the unknown. How does one arrive at OCF and how is it different from NP? Let’s first define NP and OCF, before we proceed to explore the importance of each of the terms.

NP comes from the profit and loss (P&L) statement, while OCF comes from cash flow statement.

Net Profit: Net of revenue or sales after minusing all operating expenses, depreciation, interest and taxes, including any other income and taking into account exceptional items.

Operating Cash Flows (OCF): The net cash generated from operations.

Investing Cash Flows (CFI): The net result of capital expenditure, investments, acquisitions, etc.

Financing Cash Flows (CFF): The net result of raising cash to fund the other flows or repaying debt.

Why OCF and not NP: OCF is a better metric of a company’s financial health for two main reasons. First, cash flow is harder to manipulate than net income. Second, ‘cash is king’ and a company that does not generate cash over the long term is heading towards getting wiped out. OCF gives you the picture of the cash received in the organisation. Without cash, the company may not be able to fulfill its promise to make payments to suppliers, employees and financial institutions on a sustainable basis.

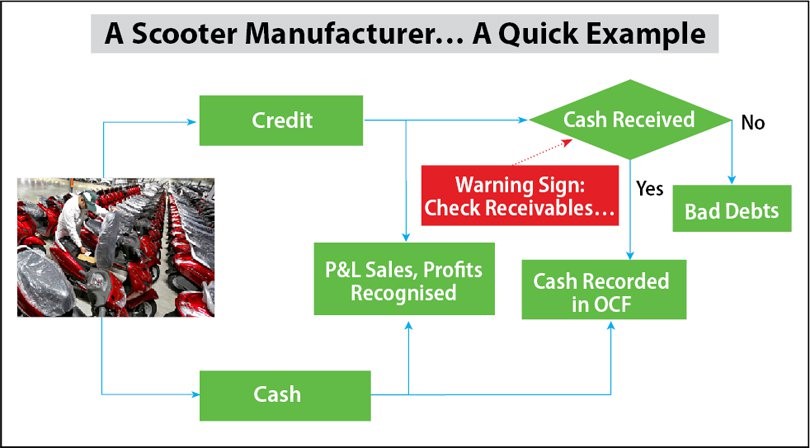

Accrual Accounting System vs Cash Flows: To generate NP, a company may be required to just make a sale. This sale could be either in cash or on credit. If it is a cash sale, it gets recognised in OCF also.

However, business reality is a bit more complex. Most companies provide credit facilities. This could provide an opportunity to manipulate the net profit numbers. Imagine a company that makes a credit sale and, based on it, immediately recognises the sales in the P&L and, accordingly, arrives at the NP number. However, the cash is not received and, hence, OCF does not go up.

What happens if the customer delays the payment or returns the goods or if the sale was bogus? This results in a build-up of receivables in the balance-sheet. But the real OCF has never happened. The company may continue to do so but not indefinitely. It will have to face the reality at some point in time. The receivables numbers then will turn bad debts and result in pain.

Seven Examples

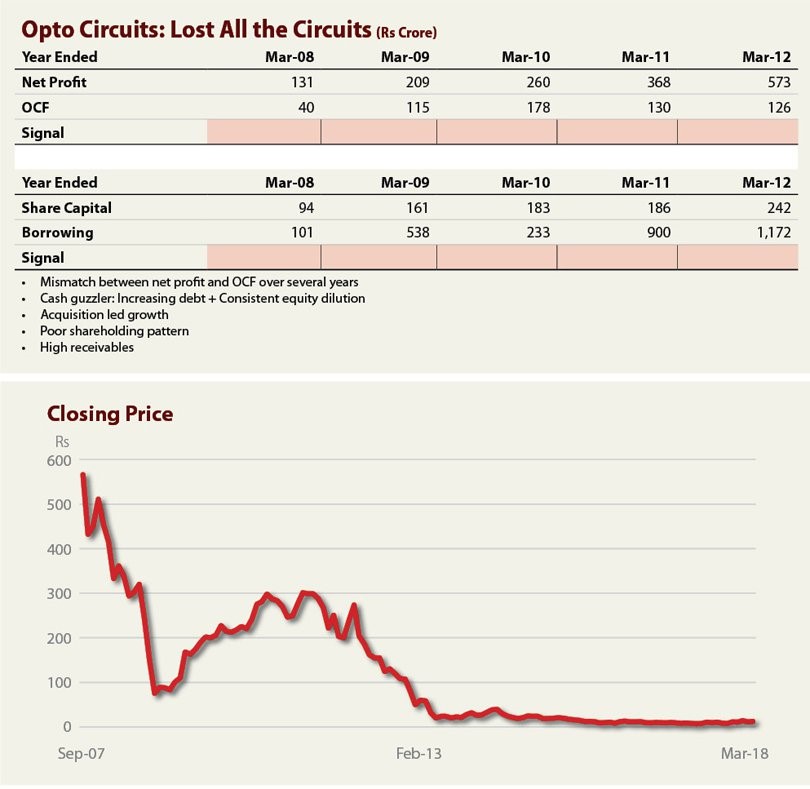

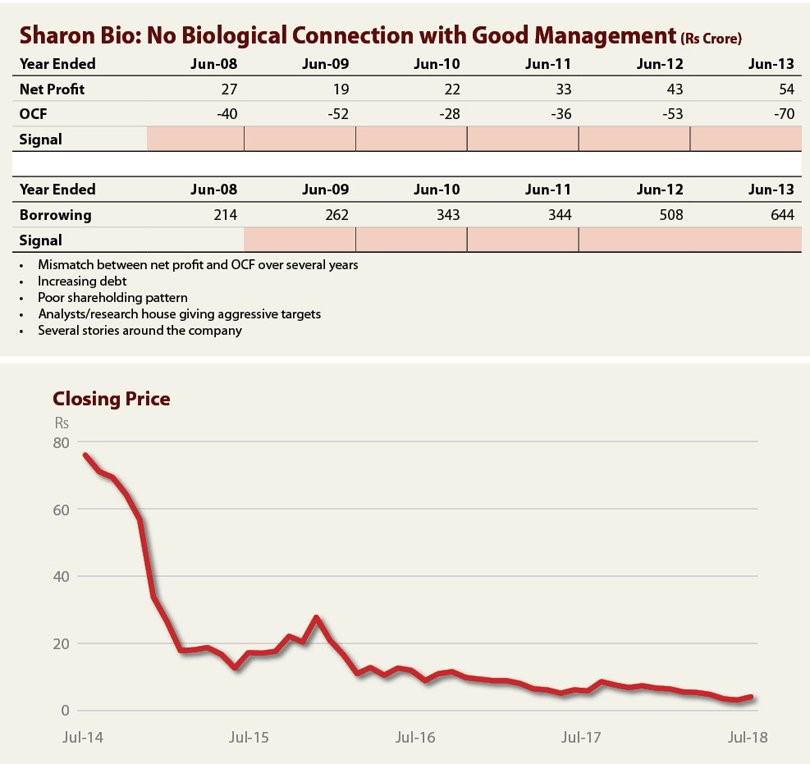

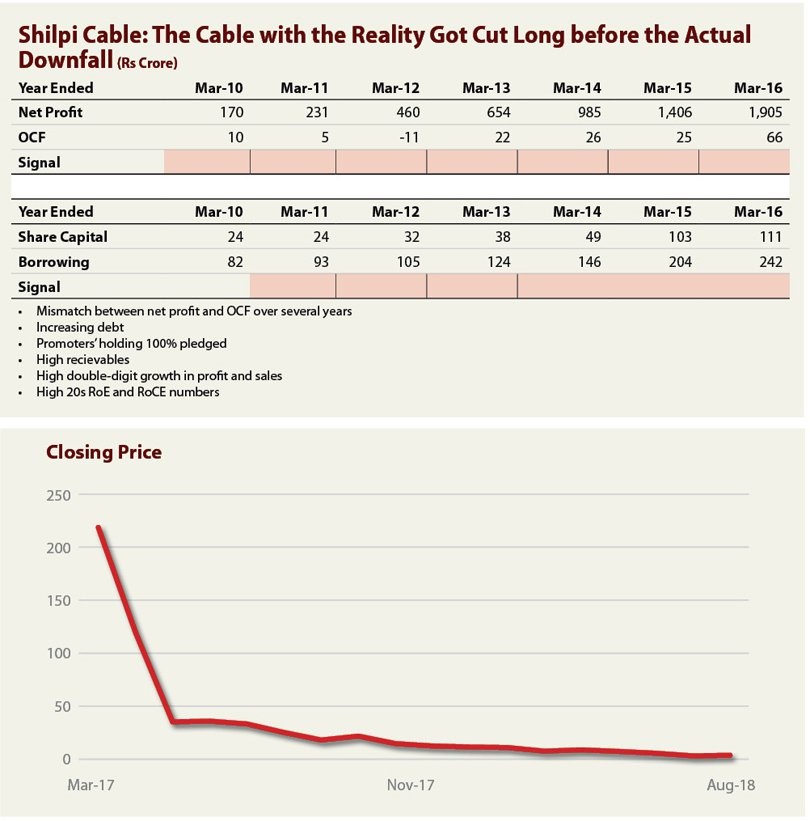

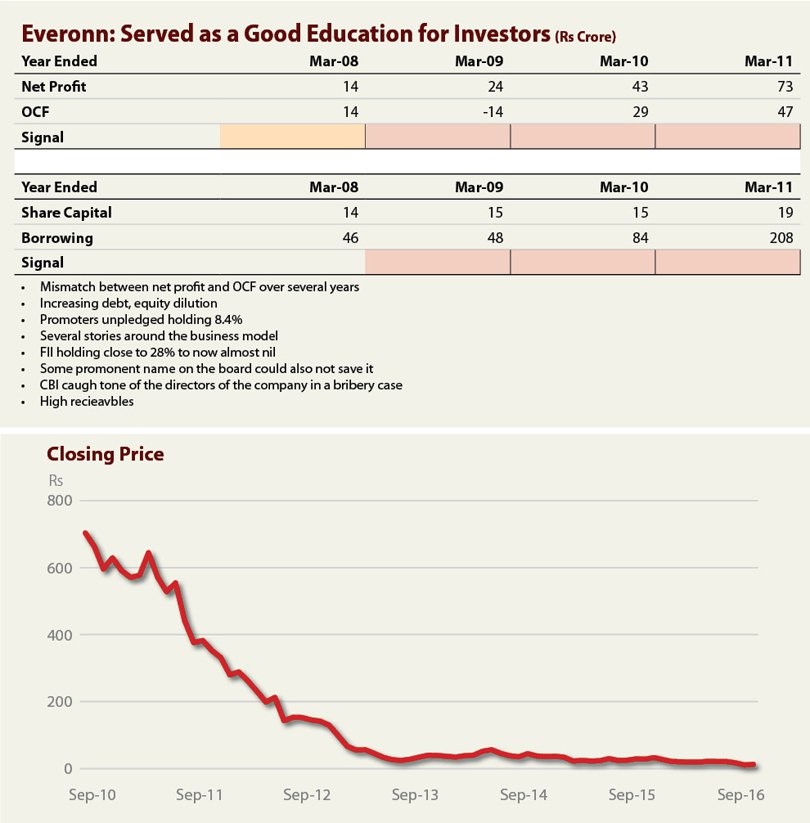

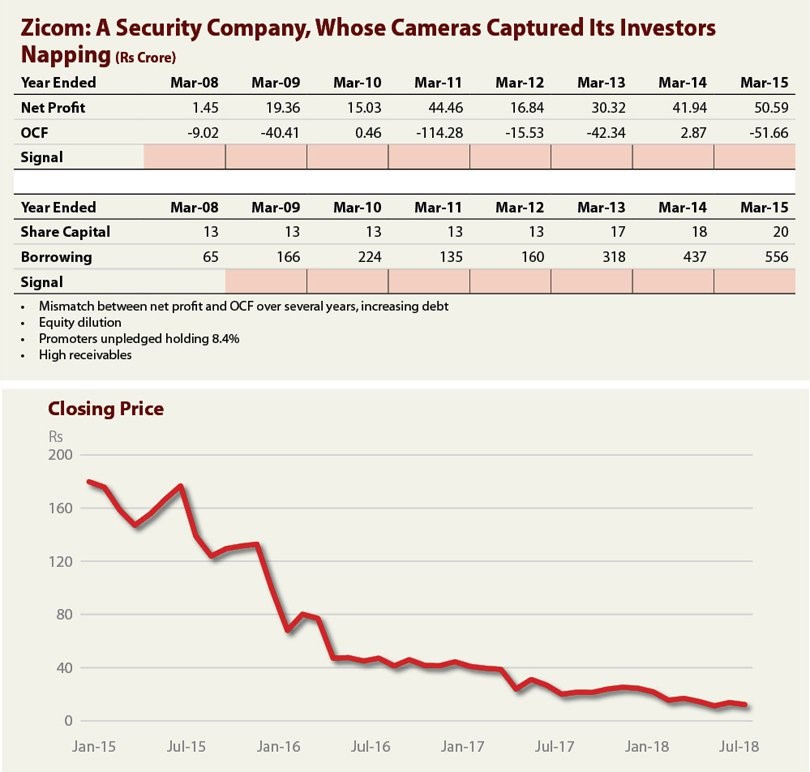

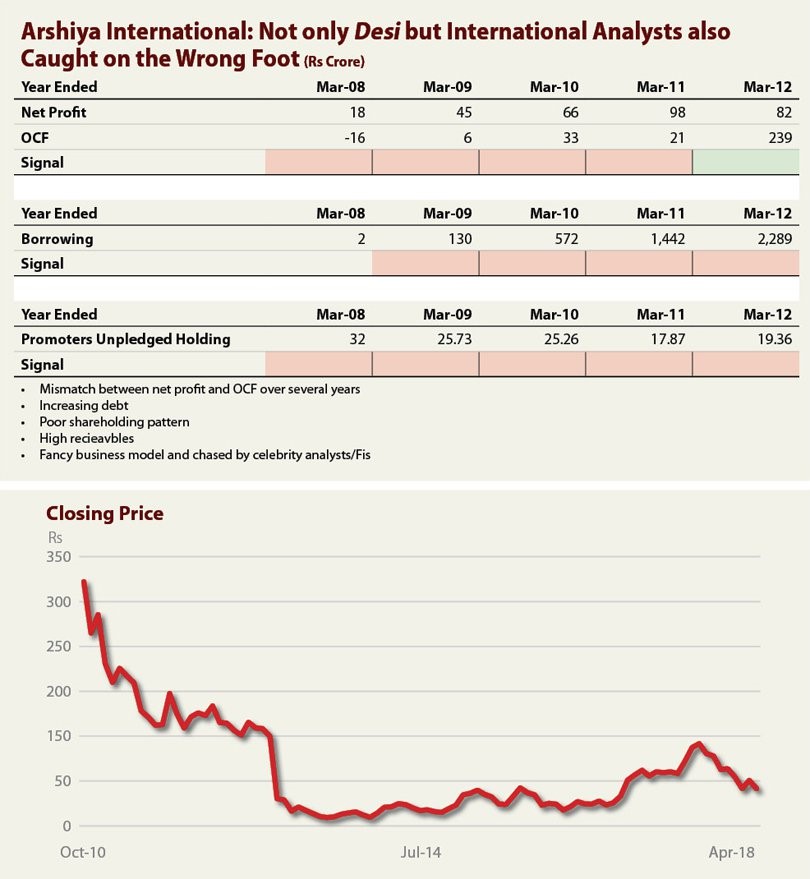

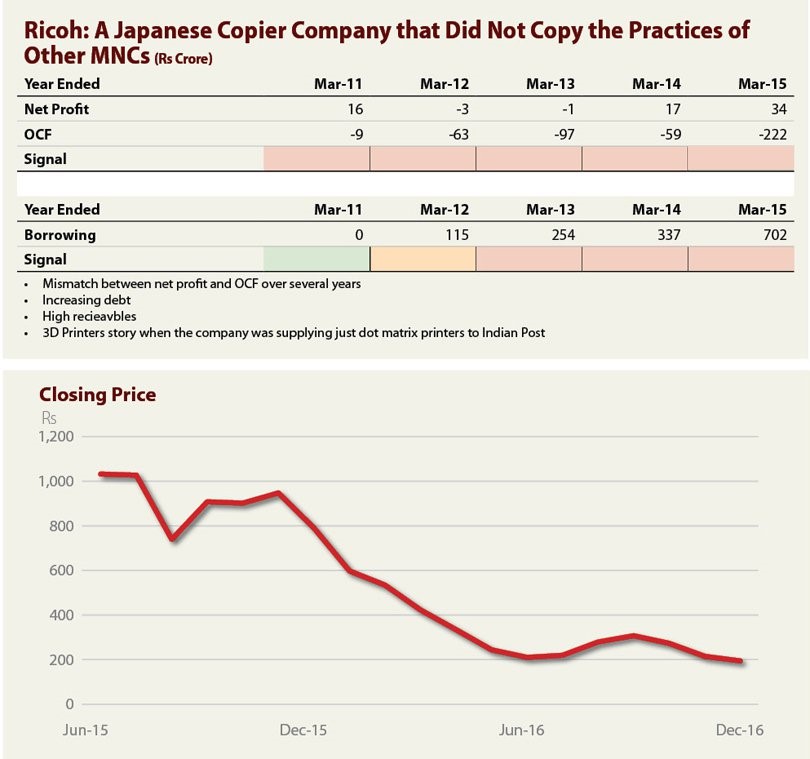

There have been several examples where companies were not generating cash flows but continued to show profits through various means. These companies faced the grim reality at some point in time and their stocks collapsed. Also, if the promoters’ holding is poor or there is a continued equity dilution along with poor OCF, it becomes a deadly cocktail.

There are hundreds of examples. I have chosen seven examples to highlight how following NP and OCF can mislead us. Why these examples? Well, these are some high-flying cases in which many media-savvy analysts, institutional investors, and retail investors have invested or have talked about them. I have discussed these companies with many friends and relatives in the past due to our mutual interest in stocks. I have taken the data only up to the point where I have analysed it last when faced with such queries.

I found a common element in companies with poor OCF. These companies are, often, backed by very strong growth stories and are widely traded in the stock market with lots of hope. These companies were the cynosure of the eyes of stock market players. In these seven cases, too, the stocks were running high with growth stories being spread by analysts and large investors. Eventually, these companies’ stocks, and those of several such companies, which were unable to generate OCF, just crashed by as much as 95% from their peak price.

Ideal Situation: How do we know what the NP should be? In an ideal situation, the ideal OCF vsNP ratio should be close to one. The higher the OCF, the better it is. However, there could be a year or two where OCF is down due to market conditions or specific circumstances. But it cannot be for an indefinite period; otherwise, the survival of the company will be in question.

OCF Can Be Fixed Too: One more word of caution. Companies can manipulate OCF also. That’s where a glance at the balance-sheet can catch any discrepancy. Positive OCF can be generated by decreasing the non-cash working capital. Decreasing non-cash working capital means liquidating items like inventory, receivables (you are supposed to get this money from your customers and not by selling it off in the market at a discount) or increasing payables (you are supposed to pay your suppliers and which you don’t).

Are these steps, like liquidating receivables, inventories or increasing payables sustainable? Not at all! Inventories and receivables cannot fall below zero and creditors will not extend credit indefinitely, unless payments are made when due.

One must go through the balance-sheet numbers to see if there are any marked changes in receivables, payables, or working capital numbers from the previous year’s numbers. If so, you know where the problem is.

Exception: There are some exceptions to the rule of OCF, especially with respect to companies that deal only with cash—that is, banks and finance companies. The OCF rule is not applicable in such cases or it needs to be tweaked extensively.

Other Helpful Parameters along with OCF

In addition to OCF, if we also consider the following parameters, it would further help us in our analysis.

- Interest paid vsnet profit: a ratio of more than 0.4/0.5 is risky

- Equity dilution on an ongoing basis

- Promoters’ unpledged holding in the company

- Trends in receivables

- Investing and financial cash flows

Final word: NP without OCF is like a body without oxygen and if it is coming with low promoter shareholding, equity dilution and high debt, it is a sure death warrant for the investor.

Reference: http://www.investopedia.com for definitions

Author and disclosure:

Niteen is one of the founders of Aurum Capital, a SEBI-registered investment adviser. Stocks mentioned in the article does not constitute personal recommendations. The analyst does not hold any of the stocks mentioned in the article above.

Note:

This article was originally published in Moneylife magazine.

Interview of Jiten Parmar discussing key principles of investing – Unlimited Abundance – Sep 2018

Dear All,

Jiten Parmar, the co-founder Aurum Capital, is interviewed by The Unlimited Abundance.

This podcast reveals his 3 principles of investing discipline which helped him amass Multibagger returns with amazing ease.

https://www.youtube.com/watch?time_continue=2&v=-lCU7UVqqPA

Please do share your inputs.

Regards,

Aurum Capital

SEBI registration No: INA000011024

Important Disclaimer:

The stocks named, if any, during the interview are for educational purpose and are not recommendations of any kind (Buy/Sell/Hold). Please consult your registered Investment Advisory or Analyst before taking any financial decisions.

Response to the quiz

First of all, let me reiterate, it was just a quiz and NOT a recommendation of any kind (buy/sell/hold). The purpose of this quiz is to make some of the readers go through the numbers. If someone reads this as a tip or recommendation then the whole purpose will be lost.

We received several responses. It has come on the blog, twitter, email, and whatnot. We are glad to receive them, as always. Thank you for your active participation.

Many of you answered it correctly though some of you got confused with Arrow Greentech, Lasa Supergen, Time Technoplast, Harita Seating, Tata Global, JHS Svendgard and HUL.

If you could not answer it correctly then also it is fine as long as you tried. What we need to do is to understand the parameters that we missed and that caused a wrong answer.

The correct answer is: Uflex Limited

Original quiz: https://aurumcapital.in/blogs/2018/08/19/identify-the-company/

Disclaimers:

The information herein is used as per the available sources of bseindia.com/nseindia.com, company’s annual reports & other public database sources. Aurum Capital is not responsible for any discrepancy in the above-mentioned data. Investors should seek the advice of their independent financial advisor prior to taking any investment decision based on this report or for the necessary explanation of its contents.

Future estimates mentioned herein are personal opinions & views of the analyst. Analyst Name – Niteen S Dharmawat. For queries/grievances – support@aurumcapital.in. SEBI registration No: INA000011024.

Readers are responsible for all outcomes arising of buying/selling particular scrip/ scrips mentioned herein. This report indicates the opinion of the author & is not a recommendation to buy or sell securities. Aurum Capital & its representatives have vested interest in above-mentioned securities at the time of this publication, and its partners/company have positions / financial interest in the securities mentioned above.

Aurum Capital or its associates are not paid or compensated at any point of time, in last 12 months by anyway from the companies mentioned in the report.

Aurum Capital, or its representatives do not have more than 1% of the company’s total shareholding. Ownership of the stock: Yes. Served as a director / employee of mentioned companies in report: No. Any material conflict of interest at the time of publishing report: No.

The views expressed in this post accurately reflect the author’s personal views about any and all of the subject securities or issuers; and no part of the compensations, if any was, is or will be, directly indirectly, related to specific recommendation or views expressed in the report.